Managing a childcare program means juggling daily learning activities, staff coordination, and family communication. With so much to do, financial record keeping can often fall behind. However, effective daycare bookkeeping is essential for your program's long-term success and stability.

In this article, we’ll explore the vital role that bookkeeping plays in running a successful childcare business. We’ll cover the basics of daycare bookkeeping, from tracking income and expenses to managing payroll and tax obligations, and best practices you can adopt for your childcare business.

What is daycare bookkeeping?

Daycare bookkeeping is the process of recording and organizing all the financial transactions related to your childcare program. It involves systematically tracking all the money that comes in and goes out of your business. This foundational practice gives you a clear and accurate picture of your program’s financial performance.

Key bookkeeping tasks include:

- Creating invoices and tracking tuition payments from families

- Recording all income and expenses

- Processing payroll for your staff

- Managing bills and paying vendors on time

- Reconciling bank accounts

Most businesses use one of two methods for their bookkeeping: single-entry or double-entry.

- Single-entry bookkeeping is the simpler method, where each transaction is recorded once as either income or an expense. It's similar to managing a checkbook and is often suitable for small, in-home childcare programs with straightforward finances.

- Double-entry bookkeeping is more complex but also more robust. Every transaction is recorded in two accounts—a debit in one account and a credit in another. This system provides a more comprehensive view of your finances and helps ensure accuracy by keeping your books in balance. It's the standard for larger programs, corporations, and LLCs.

As you manage your finances, you’ll encounter some common bookkeeping terms:

- Assets: What your program owns (cash, equipment, property)

- Liabilities: What your program owes (loans, credit card balances)

- Revenue: The total income your program generates, primarily from tuition fees

- Expenses: The costs of running your program (salaries, rent, supplies)

- Equity: The net worth of your business (Assets - Liabilities)

- Balance sheet: A list of what your daycare owns (and the value) as well as the amounts of what your business owes

- Financial statements: Reports, such as the balance sheet, the income statement, and the cash flow statement, showing financial performance and activities

- Ledger: The record of your business’s financial transactions

Managing your finances is critical to running a successful childcare program. Without a clear understanding of your cash flow, it’s difficult to plan for growth, manage unexpected costs, or ensure long-term stability.

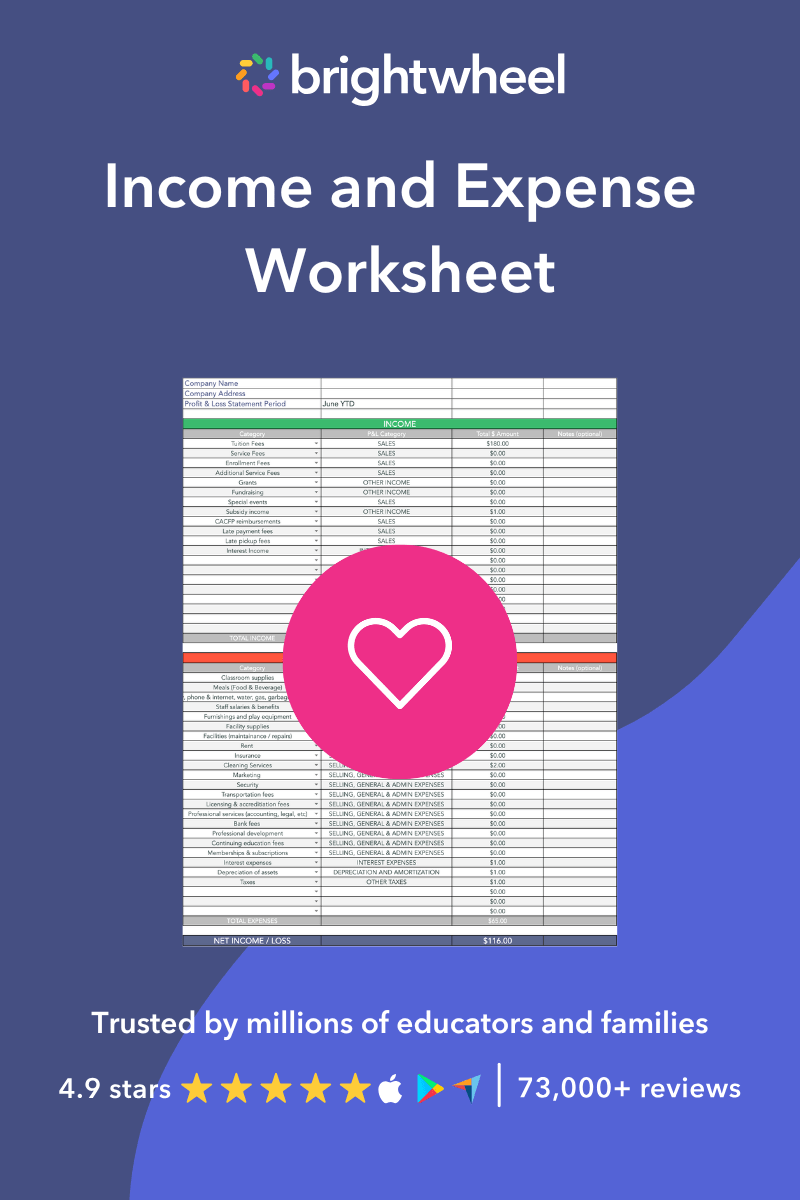

Income and Expense Worksheet

Use this free template to track your finances, make smarter spending decisions, and create a monthly budget.

Bookkeeping vs. accounting: What’s the difference?

While often used interchangeably, bookkeeping and accounting are two distinct but related functions. Understanding the difference helps you know what kind of financial support your program needs.

A bookkeeper is responsible for the day-to-day recording of financial transactions. They ensure that every transaction is accurately documented and categorized. An accountant takes this data and uses it for higher-level financial analysis and strategy.

Here’s a simple breakdown of their roles:

A bookkeeper focuses on:- Recording daily financial transactions

- Creating invoices and sending them to families

- Processing payroll

- Paying bills

- Reconciling bank accounts

An accountant focuses on:

- Analyzing financial statements to assess business performance

- Preparing and filing tax returns

- Advising on financial strategy and business growth

- Ensuring compliance with financial regulations

In short, the bookkeeper builds the financial foundation, and the accountant uses that foundation to help guide the business forward.

Why bookkeeping is important for your childcare program

Proper daycare bookkeeping is more than just a legal requirement; it’s a powerful tool for managing and growing your childcare program. Here are some of the key benefits:

- Maintain accurate financial records: Bookkeeping helps you track all financial transactions, making it easier to evaluate your program's financial health and spot mistakes. Without clear records, you might not notice if a few families missed tuition payments or if a vendor overcharged you.

- Simplify tax preparation: With organized records, tax season becomes less stressful. All necessary documents—like financial statements and cash flow reports—are readily accessible. This can save you time and money, whether you file taxes yourself or hire an accountant.

- Improve budgeting and decision-making: By understanding where your money is going, you can create a realistic budget, identify areas to save, and make informed financial decisions for your program's growth. Accurate data helps you decide when it's the right time to hire new staff, invest in new equipment, or expand your facility.

Daycare bookkeeping best practices

Setting up a solid bookkeeping system doesn't have to be complicated. Following a few best practices can help you stay organized and in control of your finances.

Create a separate business bank account

Even if you run your program as a sole proprietorship, a separate business account makes tracking income and expenses much easier and simplifies tax time. Keeping business and personal finances separate is essential for accurate record keeping. For legal structures like Limited Liability Companies (LLCs), partnerships, and corporations, a separate business bank account is legally required.

Track all your expenses

Carefully tracking every business expense helps you understand your program's spending and maximize tax deductions. Keep receipts and records for all purchases, no matter how small. Common tax-deductible expenses for childcare programs include employee wages, rent or mortgage interest, classroom supplies, food, and insurance.

Use a digital bookkeeping solution

While paper ledgers are an option, modern bookkeeping or expense management software offers several features to help childcare providers manage their finances more efficiently. Automation saves time on manual data entry, cloud access offers flexibility, and instant reports improve financial oversight. Digital tools make it easier to track payments, send invoices, and generate financial statements.

With brightwheel billing, you can automatically track expenses by connecting your bank accounts and credit cards, syncing transactions nightly. This gives you full visibility into your finances, allowing you to easily view, categorize, analyze, and report on all transactions. You can also manage receipts digitally and customize your financial tracking with personalized chart of accounts and GL codes.

Review your transactions monthly

Set aside time each month to reconcile your bank statements with your bookkeeping records. This helps you catch errors, like duplicate charges or missed tuition payments, before they become bigger problems. Regular reviews give you an up-to-date snapshot of your financial health and help you stay on top of your budget.

Pay estimated quarterly taxes

As a business owner, you are typically required to pay income taxes throughout the year in four quarterly payments. Failing to do so can result in penalties from the IRS. Use your bookkeeping records to estimate your profits and calculate how much to pay each quarter. This practice helps you avoid a large, unexpected tax bill at the end of the year.

Stay on track

An organized bookkeeping system is key to your childcare program's financial success. While manual methods can be tedious, a digital solution like brightwheel’s billing and payments feature simplifies the process. Manage tuition payments, deposit funds automatically, and centralize your financial records—all in one place. Gain clear insight into your finances and make sound decisions for your program.