As a childcare provider, your focus is on creating a nurturing environment for children. But running a sustainable business is just as critical. Navigating the world of taxes can be overwhelming, yet understanding key tax saving strategies is essential for your program's financial health.

This guide breaks down effective and practical tax saving strategies for your childcare program. We'll help you maximize your deductions, minimize your tax liabilities, and free up resources to invest back into your staff, facilities, and educational tools.

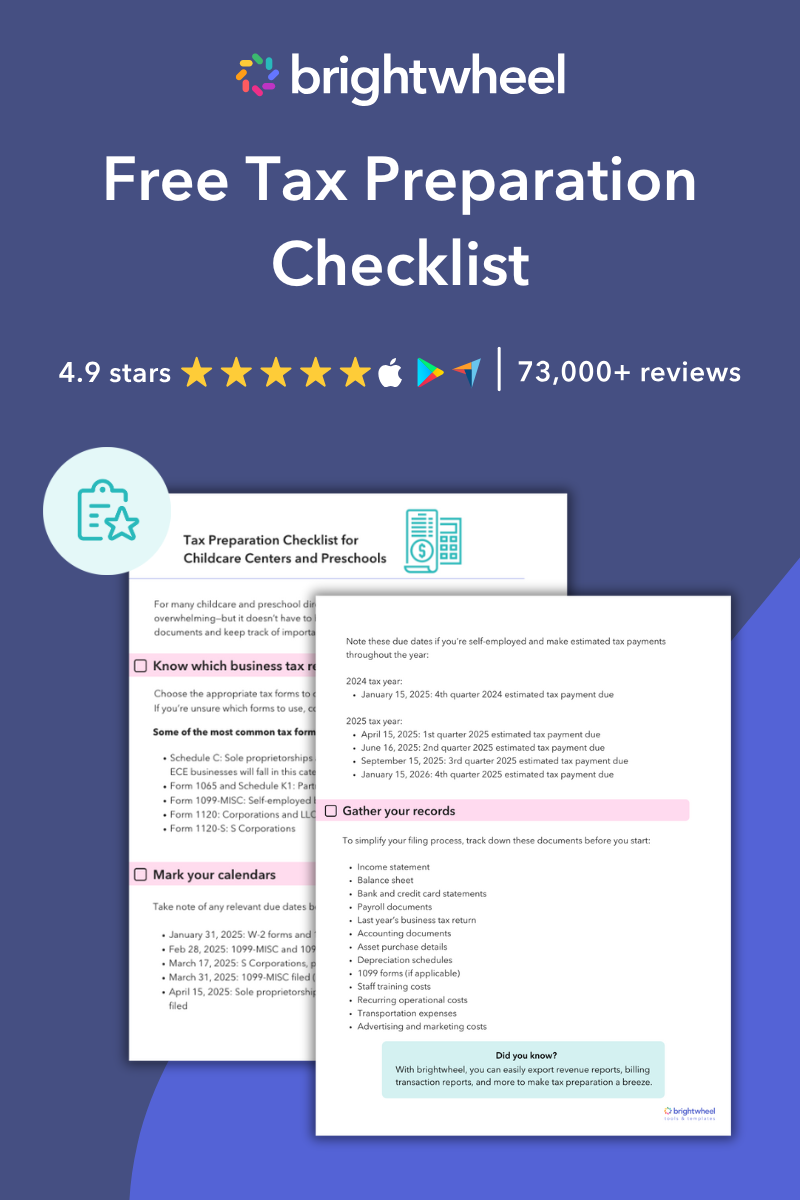

Brightwheel Webinar: Stress-Free Tax Prep for Childcare Providers

Understanding the tax landscape for childcare programs

Understanding your tax obligations is the first step in any effective tax saving strategy. It allows you to plan ahead and ensure your childcare program remains financially healthy.

Federal tax obligations:- Income tax: Tax on your program's annual earned income.

- Employment tax: If you have staff, you must withhold federal income tax, Social Security, and Medicare taxes.

State tax obligations:

- Income and employment taxes: Most states have their own income and employment tax requirements.

- Sales tax: Some states require sales tax on services or goods purchased for your program.

- Property tax: Applies if you own the facility where you operate.

- Local taxes: Your city or county may have additional business taxes or fees.

Tax saving strategies for childcare programs

Take the stress out of tax season with these tax saving strategies to help you keep more money in your business bank account.

Engage in year-round tax planning

Tax planning is an ongoing process, not just an annual event. Regularly reviewing your financial records and understanding tax obligations throughout the year helps you identify deductions, manage expenses, and prepare accurately for tax season. This proactive approach can prevent last-minute stress and ensure compliance.

Simplify your record keeping with brightwheel billing. Access financial reports and tax statements in seconds, and give families a direct link to their year-end statements, saving you valuable time from having to manually pull reports for each family.

Optimize your cash flow and budget

Keeping track of the money coming in and going out of your business is key to staying financially healthy and prepared for tax season. A cash flow statement gives you a simple snapshot—showing where your funds are going and what’s coming in—so you can better plan for upcoming expenses or changes in income. With brightwheel billing, you can easily access reports at any time to view balances, deposits, transactions, and revenue.

A straightforward budget helps you spot potential savings, track deductible expenses, and see exactly how your money is being used. Brightwheel reports make it easy to export your billing data to QuickBooks Online, so you can handle your accounting tasks smoothly and save time.Review your business structure

The business structure of your childcare program will affect how you’re taxed, so choose the right one with favorable tax conditions. Below we discuss common business structures and how they’re taxed.

Sole proprietorship

A sole proprietorship is operated by one individual responsible for filing and paying business taxes on their individual returns.

-

Pros: Easy to set up; business taxes are filed on your personal return.

-

Cons: No legal separation between personal and business assets; you are personally liable for all business debts.

Partnership

A partnership is owned and operated by two or more partners who contribute skills, finances, property, and share in the business’s profits and losses.

Pros:- Simple to establish and maintain.

- Shared responsibility and workload among partners.

- Potentially increased access to capital through multiple owners.

Cons:

- Each partner is liable for business debts and decisions made by other partners.

- Potential conflicts between partners over business decisions.

- Profits must be shared among partners.

Limited liability company (LLC)

An LLC protects you from personal liability in most instances and allows you to take advantage of the benefits of both a corporation and partnership business structure.

Pros:- Owners are not personally liable for business debts and liabilities.

- Flexible management structure and fewer compliance requirements compared to corporations.

- Pass-through taxation avoids double taxation.

Cons:

- Typically higher setup and maintenance costs than sole proprietorships or partnerships.

- LLC laws and tax treatment can vary by state, adding complexity.

- Limited growth potential compared to corporations when seeking investors.

Corporation

A corporation is a legal entity owned by shareholders. Unlike a sole proprietorship and partnership, it’s separate from its owners and has the same rights as them.

Pros:- Owners (shareholders) have limited liability.

- Easier to raise capital by selling stock.

- Enhanced credibility and permanence as a business structure.

Cons:

- More complex and expensive to set up and operate.

- Subject to double taxation (corporate income and shareholder dividends).

- Increased regulatory and reporting requirements.

Invest in your program and staff

The money you spend on professional development and other continuing education materials for staff training can be deducted from your business taxes. Not only can this training enhance employees’ skills and, consequently, the quality of childcare services provided by your business, but it may also lower your taxable income.

- Employee training and education: Deduct expenses for professional development that enhances your staff's skills.

- Retirement plans (401k): Employer contributions are generally tax-deductible and help attract and retain top talent.

- Section 125 cafeteria plans: Reduce your payroll tax liability by allowing employees to pay for benefits like health insurance pre-tax.

Leverage energy-efficient upgrades

You may be able to claim a significant tax deduction for making your building more energy-efficient. Under the Inflation Reduction Act, you can now deduct the costs of energy-efficient improvements to your commercial building's lighting, HVAC, and building envelope. To maximize your deduction, ensure your project meets the required energy savings percentages. Consult a tax professional to see how these upgrades can lower your tax bill.

Stay informed about changing tax laws

Tax laws and regulations are constantly evolving, so business owners and administrators must stay updated to ensure compliance, avoid overpaying taxes, and identify tax opportunities that may help save money on taxes.

Common Tax Write-Offs for Childcare Businesses

A free guide of common tax write-offs for childcare providers.

Key tax deductions for childcare programs in 2025

Tax deductions reduce the amount of income that is subject to taxation. For example, if you have $10,000 in taxable income and claim a $2,000 tax deduction, you'll only be taxed on $8,000. Deductions can help lower your taxable income, reducing the amount of taxes you owe.

Take advantage of these tax deductions for your childcare business:

- Operating expenses: Staff wages, facility maintenance, and vehicle costs.

- Supplies and equipment: Toys, educational materials, furniture, and art supplies.

- Depreciation of assets: Recover the cost of large purchases like vehicles or office equipment over time using Section 179.

- Meals and snacks: The cost of food provided to children in your care is fully deductible.

- In-home childcare expenses: If you run your program from home, you can deduct a portion of your rent, mortgage interest, utilities, and insurance.

- Business insurance: Premiums for liability, property, and group health insurance are deductible.

- Professional and membership dues: Fees for organizations like NAEYC or state childcare associations.

- Advertising expenses: Costs for print, online, or local radio ads to promote your program.

- Bank fees and loan interest: Fees on your business bank account and interest paid on business loans.

- Continuing education: Costs for workshops, conferences, and books that are directly relevant to your business.

A payroll software like brightwheel payroll can automate your federal, local, and state payroll taxes, saving you valuable time and maintaining all your payroll records in the same platform you use for admissions and billing.

Top tax credits for childcare programs in 2025

Tax credits directly reduce the amount of tax you owe. It's like getting a dollar-for-dollar reduction in your tax bill. For example, if you have a $5,000 tax bill and qualify for a $2,000 tax credit, your tax liability will be reduced to $3,000.

Tax credits are typically more valuable than deductions because they offer a direct reduction in the amount of tax owed. Consider the below tax credits that can help offset the costs associated with providing high-quality child care:

- Work Opportunity Tax Credit (WOTC): The WOTC allows you to claim a tax credit for hiring individuals from specific groups that face employment barriers, such as qualified veterans or qualified ex-felons.

- Small Business Health Care Tax Credit: To qualify for this credit, your business must have fewer than 25 full-time employees, pay at least 50% of their health insurance premiums, and meet other requirements.

Make tax season work for you

Implementing smart tax saving strategies is vital for the financial success of your childcare program. By maximizing deductions, exploring tax credits, and keeping meticulous records, you can significantly reduce your tax liability.

Every dollar you save is a dollar you can reinvest into providing higher-quality care, improving your facility, and supporting your staff. Stay proactive with your tax planning to ensure your program not only survives but thrives.

This article is designed to provide general information regarding the subject matter covered. It is not intended to serve as legal, tax, or other financial advice related to individual situations. Because each individual's legal, tax, and financial situation differs, specific advice should be tailored to the particular circumstances. For this reason, you are advised to consult with your own attorney, CPA, and/or other advisors regarding your specific situation.