Tax season doesn't have to be overwhelming for childcare providers. This comprehensive guide covers everything you need to know about childcare provider taxes for 2025, including deductions, credits, and filing requirements. Whether you're running a small in-home daycare or managing a large childcare program, we'll help you navigate tax season confidently and maximize your savings.

Running a childcare business comes with unique financial considerations that differ significantly from other industries. Understanding these tax implications can save you thousands of dollars annually while ensuring compliance with federal regulations.

The childcare industry generates billions in revenue annually, yet many providers miss out on valuable deductions simply because they don't know what qualifies. This guide will help you identify every legitimate tax benefit available to your childcare business in 2025.

Why childcare provider taxes are different

Childcare providers face unique tax situations that set them apart from other business owners. Unlike traditional businesses, childcare operations blend personal and professional expenses in ways that require careful documentation and specific knowledge of IRS regulations.

The nature of childcare work often involves using your home for business purposes, caring for children with special dietary needs, and maintaining extensive safety equipment. These activities create tax opportunities that don't exist in most other industries.

Additionally, childcare providers often qualify for specialized credits and deductions related to food programs, professional development, and child safety equipment. The IRS recognizes the essential role childcare plays in supporting working families and has created specific provisions to support childcare businesses.

State regulations also vary significantly for childcare providers, creating additional layers of tax considerations. Some states offer additional credits or deductions specifically for childcare businesses, while others have unique licensing requirements that affect your tax situation.

How to prepare childcare provider taxes

Proper preparation is essential for maximizing your tax benefits and ensuring accurate filing. Start by gathering all financial records from the previous tax year, including income statements, expense receipts, and bank statements.

Create separate folders for different expense categories such as supplies, equipment, professional development, and vehicle expenses. This organization will streamline the filing process and help ensure you don't miss any deductions.

Essential documents to collect include:

- Income statements

- Bank statements for business accounts

- Receipts for supplies, equipment, and materials

- Vehicle mileage logs for business trips

- Professional development certificates and receipts

- Insurance policy statements

- Utility bills and rent receipts if applicable

Maintain detailed records throughout the year rather than scrambling during tax season. Consider using accounting software or apps specifically designed for small businesses to track expenses automatically.

Review your business structure to ensure it's still optimal for your current situation. Many childcare providers benefit from LLC or S-Corp structures, but individual circumstances vary significantly.

Schedule time with a tax professional who understands childcare businesses. Their expertise can often save you more money than their fees cost, especially when navigating complex deductions.

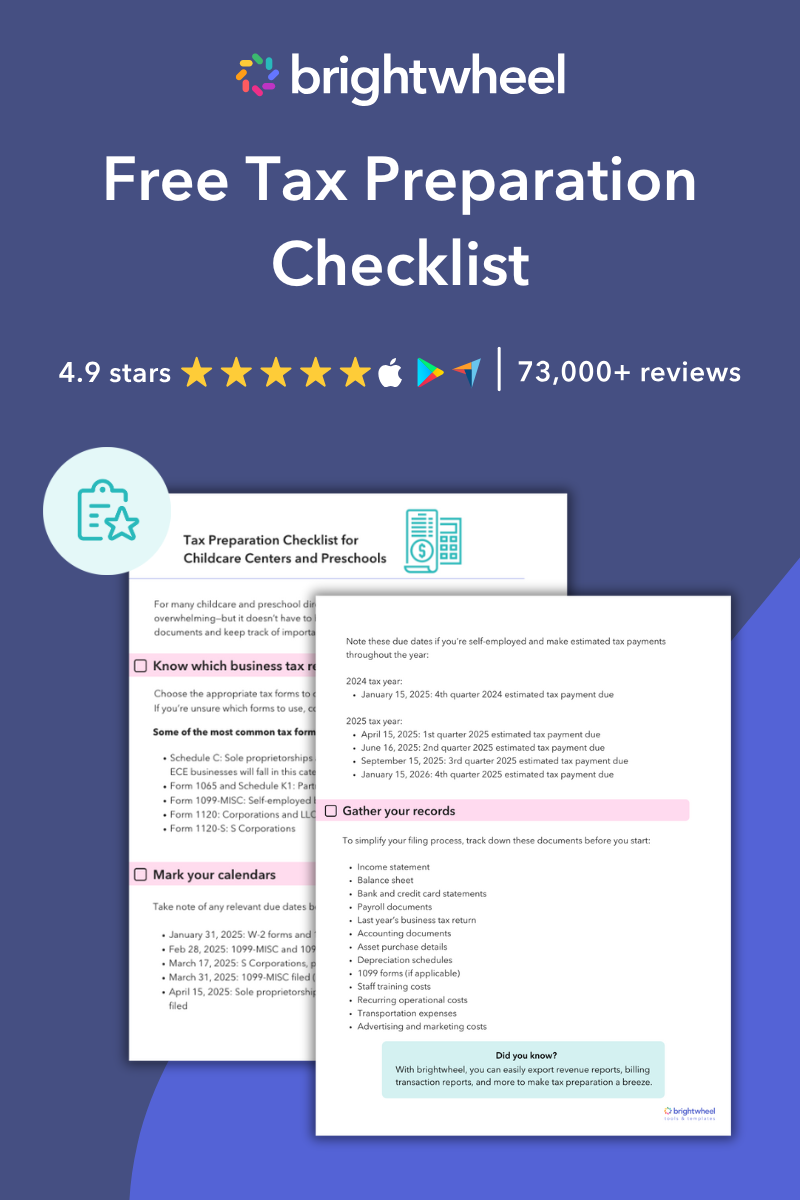

Tax preparation checklist

Filing your taxes can be challenging; however, the right checklist can make the process easier. To prepare for your taxes, you’ll need to:

- Find out when your taxes are due

- Gather the appropriate tax forms

- Collect your business income records

- Gather your receipts for business expenses

- Request an extension if needed

2025 Tax Preparation Checklist for Childcare Centers and Preschools

Use this free checklist to stay organized during tax season.

Use the list below to compile the necessary documents you’ll need to file.

General documents

- Federal tax ID number

- Social security number

- Previous tax returns (up to three years)

Financial statements

- Income statement

- Balance sheet

- Bank and credit card statements

- Bank deposit slips

- Accounting documents

Business-related expenses

- Grouped receipts:

- Supplies

- Recurring operational costs:

- Rent

- Utilities

- Subscription-based services

- Transportation expenses

- Advertising and marketing

- Staff training costs

- Professional fees (e.g. accountants, attorneys, and consultants)

- Insurance policies (e.g. individual and group plan documents, company vehicle policies)

- Asset purchase details

- Depreciation schedules

- Payroll reports

Tax forms

- Form 1040: Annual income tax return for individuals

- Schedule C: Sole proprietorships and single-member LLCs

- Form 1065 Schedule K-1: Partnerships and multi-member LLCs

- 1099-MISC: Self-employed business owners

- Form 1120: Corporations and LLCs taxed as corporations

- Form 1120-S: S corporations

Top tax deductions for childcare provider taxes

Childcare providers can claim numerous deductions that significantly reduce their taxable income. Understanding which expenses qualify can result in substantial tax savings.

- Supplies and materials represent one of the largest deduction categories for childcare providers. This includes art supplies, educational materials, cleaning products, diapers, and any items purchased specifically for your childcare business.

- Food expenses can be substantial for providers participating in the Child and Adult Care Food Program. Even if you're not in the program, you can deduct costs for snacks and meals provided to children in your care.

- Home office and space deductions allow you to deduct portions of your home expenses when you use part of your residence exclusively for child care. This includes utilities, rent or mortgage interest, and home maintenance costs.

- Equipment and furniture purchases for your childcare business qualify for immediate deduction or depreciation. Playground equipment, cribs, high chairs, and safety gates all fall into this category.

-

Facility costs for commercial spaces, including rent, utilities, maintenance, and property insurance, are deductible.

- Staff salaries and benefits, including wages for teachers and assistants, as well as health insurance or retirement contributions, are fully deductible.

- Vehicle expenses for transporting children or purchasing supplies can be deducted using either actual expenses or the standard mileage rate. Keep detailed logs of business-related trips.

- Professional development costs including training courses, conferences, and certifications required for your license are fully deductible. Books and educational materials also qualify.

- Insurance premiums for liability coverage specific to your childcare business can be deducted. Some providers also qualify for health insurance deductions depending on their business structure.

- Marketing and advertising expenses for promoting your childcare services, including website costs, business cards, and local advertising, are deductible business expenses.

- Other business fees, such as licensing costs, professional memberships, business software subscriptions, and bank charges, are also deductible expenses.

Tax credits for childcare providers in 2025

Tax credits provide dollar-for-dollar reductions in your tax liability, making them more valuable than deductions. Several credits specifically benefit childcare providers in 2025.

- Small Business Health Care Tax Credit helps small childcare businesses afford employee health insurance. If you have fewer than 25 full-time equivalent employees and provide health insurance, you may qualify for up to 50% credit on premiums paid.

- Work Opportunity Tax Credit applies when you hire employees from certain targeted groups, including veterans, ex-felons, or individuals receiving government assistance. This credit can provide up to $2,400 per qualifying employee.

- Commercial Clean Vehicle Credit offers childcare businesses an opportunity to save when transitioning to eco-friendly transportation. If your business purchases qualified clean vehicles, such as electric vans or buses used to transport children, you may be eligible for a tax credit of up to $7,500.

- The Child and Dependent Care Credit may apply to childcare providers who also have their own children in care while working. This credit can reduce your tax liability by up to $3,000 for one child or $6,000 for multiple children.

State-specific credits vary by location but often include incentives for childcare providers who serve low-income families or operate in underserved areas. Research your state's specific offerings to maximize available credits.

Equipment purchases may qualify for Section 179 deduction, allowing you to deduct the full cost of qualifying equipment in the year of purchase rather than depreciating it over several years.

Use brightwheel for record keeping and tax prep

Accurate record-keeping is fundamental for efficient tax preparation. It ensures you can clearly account for all income and expenses, allowing you to claim eligible deductions and maintain compliance.

Key records to maintain include:

- Financial statements: These documents detail your income, expenses, and overall financial health, providing essential information for tax authorities.

- Receipts and invoices: Keep meticulous records of all business expenditures, such as supplies, rent, and other operational costs. These serve as proof for claiming deductions.

- Employee records: Document staff payroll, tax withholdings, and benefits provided. Accurate employee records are critical for meeting employer tax obligations.

Maintaining organized records throughout the year simplifies tax season, ensures compliance, and supports your childcare business's financial stability.

With brightwheel's billing feature, you centralize access to critical reports and data. Generate student transaction summaries, revenue reports, and detailed billing transaction reports with ease. This provides a comprehensive overview of your financial activity, streamlining your tax preparation process.

Daycare receipts and tax statements

During tax season, you must provide business income and expense information to the government. You will also receive requests from families for daycare receipts. A childcare receipt documents the total payments a family made for care between January 1 and December 31 of the previous year. Parents and guardians require this information to claim childcare expenses and receive applicable tax credits.

The Child and Dependent Care Tax Credit is a tax credit designed to help working individuals offset the costs of caring for a child or dependent with disabilities. Unlike a deduction, which reduces taxable income, this credit directly reduces taxes owed. Families can save significant amounts by claiming eligible childcare expenses annually.

The IRS provides a sample template for childcare providers to issue these statements:

<Insert today's date>

<Insert parent/guardian’s name and address>

Re: <Insert child's name>

To Whom It May Concern:

According to our records, <name of care provider> provided childcare service(s) for <child's name> on the following date(s) <insert the date(s) you provided service(s)> in <insert tax year on the notice>.

Our records show the child lived at <street address, city, state, zip code (if the child moved during the year show all addresses)> during this time. Our records also show the child’s parent or guardian during this time was <insert parent's or guardian’s name(s)>. Their address of record during this time was listed as <insert parent's or guardian’s address(es)>.

Sincerely,

<Insert signature of childcare provider or official>

<Insert title of childcare provider>

<Insert phone number of childcare provider>

Ensure you include the total amount received for childcare services to complete the document.

Provide these essential documents to families promptly, allowing them ample time to file their taxes. Brightwheel's billing software for childcare providers automates this process by notifying families when their year-end tax statements are available. This reduces inquiries to your staff and provides families with a direct, downloadable link to their statements, containing all necessary tax season information.

Brightwheel Webinar: Stress-Free Tax Prep for Childcare Providers

Tax strategies for childcare providers in 2025

Strategic tax planning throughout the year can significantly impact your final tax liability. Implementing these strategies can help maximize your savings and improve your business's financial health.

- Timing equipment purchases can optimize your tax benefits. If you're planning major equipment acquisitions, consider whether purchasing before year-end provides better tax advantages than waiting until the following year.

- Retirement contributions reduce your current taxable income while building your future financial security. SEP-IRAs and Solo 401(k)s offer higher contribution limits for self-employed individuals.

- Quarterly estimated tax payments help avoid penalties and manage cash flow throughout the year. Calculate your expected annual income and make regular payments to prevent a large tax bill in April.

- Business entity optimization may provide tax advantages as your childcare business grows. Converting from sole proprietorship to LLC or S-Corp status can offer additional deduction opportunities and liability protection.

- Professional development scheduling can be strategically timed to maximize deductions while improving your services. Plan training and certification renewals to coincide with your tax planning goals.

- Record keeping systems should be established and maintained consistently. Digital receipt tracking and expense categorization throughout the year prevents missed deductions and reduces preparation time.

- Family employee considerations apply when hiring your spouse or children in your childcare business. These arrangements can provide tax advantages while keeping business income within your family.

Tax filing deadlines

Staying on top of key tax filing deadlines is critical for avoiding penalties and maintaining smooth operations. Here are the important dates to remember for 2026:

- January 15, 2026: Fourth quarter estimated tax payment for 2025 is due.

- April 15, 2026: Deadline to file individual tax returns (Form 1040) or request an extension. First quarter estimated tax payment for 2026 is also due.

- June 15, 2026: Second quarter estimated tax payment for 2026 is due.

- September 15, 2026: Third quarter estimated tax payment for 2026 is due.

- October 15, 2026: Final deadline to file extended 2025 tax returns.

Marking these dates on your calendar and setting reminders can help ensure timely compliance with tax obligations.

Conclusion

Managing childcare provider taxes becomes significantly easier with proper planning and organization throughout the year. The strategies and deductions outlined above can result in substantial savings when properly implemented.

Working with a qualified tax professional who understands the childcare industry ensures you're taking advantage of every available opportunity while maintaining compliance. By prioritizing organization, knowledge, and expert support, you can navigate tax season confidently and optimize your financial outcomes.

This article is designed to provide general information regarding the subject matter covered. It is not intended to serve as legal, tax, or other financial advice related to individual situations. Because each individual's legal, tax, and financial situation differs, specific advice should be tailored to the particular circumstances. For this reason, you are advised to consult with your own attorney, CPA, and/or other advisors regarding your specific situation.