Running a childcare program comes with its fair share of challenges, but learning how to run a daycare effectively can help you achieve long-term financial sustainability. Managing tight budgets and unpredictable cash flow can feel overwhelming, especially when paired with the daily demands of running a nurturing, high-quality program.

However, with the right strategies in place, you can streamline operations, boost revenue, and set your childcare program up for lasting success. This article will explore key steps for financial sustainability to build a thriving program.

Focus on business fundamentals

A solid business plan is the foundation of a successful childcare program. Regularly review your plan and align your goals with key business fundamentals. This allows you to evaluate your finances and adapt quickly to changes in your program's income or the broader childcare industry.

Monitoring how your goals align with the following business fundamentals can help you create a successful, financially sustainable childcare program:

-

Understand the market: Knowing the current market is essential. Is there a high demand for childcare in your community, or is the market saturated? If other programs exist, you must differentiate yours. Identify your unique selling proposition—what makes your program stand out? Clearly defining why families should choose you over a competitor is key to attracting new families.

- Manage finances: Track your program's finances closely to avoid overspending. This ensures you can cover expenses, pay your staff, and build an emergency fund. Use tools like bookkeeping software and a childcare management system like brightwheel to simplify tracking income, expenses, and other record keeping processes.

- Develop a marketing plan: A strong marketing plan helps families discover your services, which leads to higher enrollment and revenue. A plan gives you a clear strategy for positioning your program as the best choice in the community.

- Train your staff: Your educators' skills need regular updates. Provide training opportunities that introduce teaching strategies based on the latest child development research. This also improves their understanding of health and safety procedures, ensuring a safe learning environment.

Create a budget for your daycare business

Creating a comprehensive budget is essential for the long-term success of your daycare business. Start by identifying all potential expenses, including facility costs, utilities, staff salaries, supplies, food, insurance, and licensing fees. Don’t forget to account for unexpected costs, such as repairs or additional materials. Once you’ve outlined your expenses, estimate your expected revenue based on enrollment capacity and tuition rates.

A well-planned budget will help you allocate resources effectively and ensure your daycare operates smoothly without financial stress. Consider using digital tools like brightwheel billing to streamline expense tracking and financial planning, allowing you to focus more on providing quality care. Regularly reviewing and updating your budget will also help you adapt to changes, such as an increase in enrollment or new regulations, while keeping your business financially healthy.

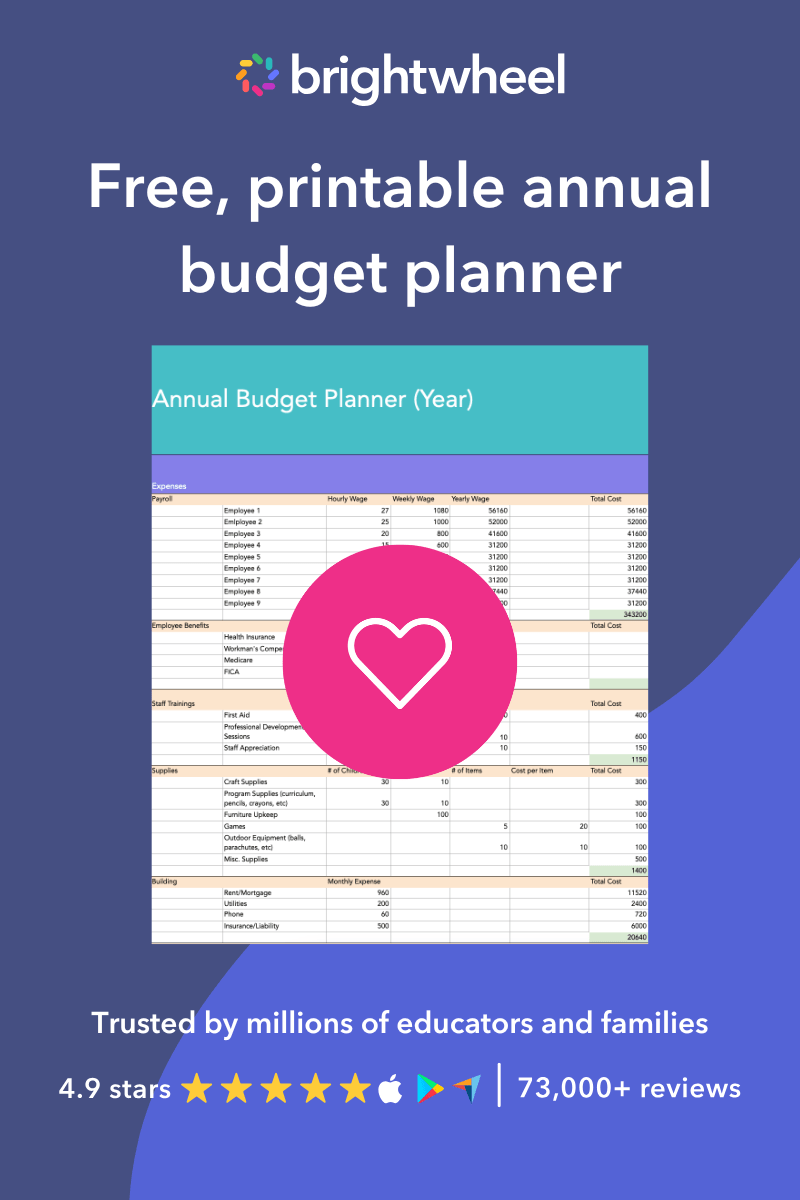

Free, Printable Annual Budget Planner

Use this planner to create a high-level budget or business plan for your childcare center.

Maximize tax benefits

Maximizing your tax benefits can help you save money that can be s et aside for the following year's expenses. When preparing for tax season, look for ways to lower your childcare program's tax liability to save as much money as possible.

You can maximize your tax benefits by deducting your childcare center or daycare's business-related expenses, including:

- The cost of supplies, rent, utilities, and maintenance

- The cost of meals provided to your children

- Staff salaries and employee benefits

- Staff training costs

- Advertising and marketing expenses

- Equipment costs

Implement an efficient billing system

An efficient billing system is essential for increasing the financial sustainability of your childcare business. By adopting user-friendly childcare management software, you can streamline invoicing, automate payment reminders, and offer multiple payment options to parents. This reduces late payments, improves cash flow, and saves time on administrative tasks.

Additionally, maintaining clear, transparent billing policies enhances trust and communication with families, fostering stronger relationships and ensuring financial stability.

Work to maintain, then increase revenue

As a childcare program owner, maintaining a steady stream of revenue is essential for your business’s financial health. Consistent income each month ensures you can meet fixed expenses like rent and payroll without interruption, allowing you to continue delivering high-quality care.

By implementing reliable systems for tuition and fee collection—and by exploring diverse revenue opportunities—you can create a stable foundation that supports both your planned operations and any unexpected costs that may arise.Charge the right tuition

Charging tuition is one of the main strategies providers use to ensure steady revenue. While there’s no single best approach to tuition management, there are several common models to consider:

- Full-time tuition: This is the most common method where parents are charged a fixed monthly or weekly fee for full-time care, typically based on the number of days their child attends per week.

- Part-time tuition: For families who require less than full-time care, offering part-time tuition options can be beneficial. Providers can charge a reduced fee based on the number of days or hours the child attends.

- Drop-in or hourly rates: Some parents may need occasional or irregular childcare services. Offering drop-in or hourly rates allows them to pay for the specific hours or days they need, providing flexibility and catering to their individual needs.

- Contractual agreements: Childcare providers can offer contractual agreements with families, allowing them to secure a spot for their child for a set period, such as a semester or academic year. This ensures consistent enrollment and revenue for the provider.

- Registration or enrollment fees: Charging a one-time registration or enrollment fee is a common practice in the childcare industry. This fee helps cover administrative costs and secures a spot for the child.

- Late pickup fees: To discourage families from picking up their children late, providers can implement late pickup fees. This incentivizes punctuality and compensates staff for their additional time.

Create new revenue streams

In addition to collecting tuition and other fees, you may want to explore new revenue streams for your childcare business. Here are some effective ways to diversify revenue and expand offerings:

- Enrichment programs: By offering enrichment programs, such as music, art, dance, or language classes, childcare programs can attract a wider range of families and provide additional learning opportunities for children. These programs can be offered as optional add-ons, allowing parents to choose the activities that best suit their child's interests.

- Summer camps: During the summer months, when many families are seeking engaging and supervised activities for their children, offering a summer camp can be a great revenue booster. Structured around fun and educational themes, these camps can include outdoor adventures, arts and crafts, sports, and other age-appropriate activities.

- After-school programs: Extending services beyond regular childcare hours by offering after-school programs can be an excellent way to generate additional revenue. These programs can provide homework assistance, tutoring, and engaging activities that keep children stimulated and entertained until their parents pick them up.

- Parent workshops and events: Organizing workshops and events for parents not only strengthens the bond between the childcare center and families but can also serve as a revenue stream. Topics can range from parenting tips and early childhood development to health and nutrition. Charging a nominal fee for participation in these events can contribute to a program's overall revenue.

- Birthday parties and events: Utilize your facilities and expertise by offering birthday party packages or hosting special events. Providing a safe and engaging environment for children's celebrations can be an attractive option for families looking for convenient party venues, generating additional income for the business.

- Before and after-school care: Collaborating with local schools to offer before and after-school care services can be mutually beneficial. This allows working parents and guardians to have extended care options for their children while providing the childcare center with a stable source of additional revenue.

Reduce your expenses

In addition to exploring new ways to generate revenue, proactively finding opportunities to cut costs can significantly improve your financial stability without compromising the quality of care. By implementing smart cost-saving strategies, you can create a more sustainable business model. Here are six actionable ways to reduce expenses:

- Optimize energy efficiency: Lower utility costs by investing in energy-efficient appliances, installing programmable thermostats, using LED lighting, and ensuring proper insulation. Encourage staff to reduce energy usage by turning off lights and electronics when not in use.

- Streamline supply management: Save on essential items like diapers, wipes, cleaning supplies, and art materials by buying in bulk or sourcing from wholesale suppliers. Regularly review inventory levels, minimize waste, and negotiate better prices to reduce ongoing supply costs.

- Invest in cost-effective staff training: Explore free or low-cost training options, such as online courses, webinars, or workshops from local organizations. Leverage internal expertise for peer-to-peer training or mentoring programs to enhance staff skills without incurring additional expenses.

- Automate administrative tasks: Use digital tools like childcare management software such as brightwheel to simplify processes such as attendance tracking, billing, and record keeping. Automating these tasks reduces paperwork and frees up staff time to focus on more impactful responsibilities.

- Collaborate with other childcare providers: Partner with local childcare programs to save on shared resources. Consider joint purchasing agreements for supplies, co-marketing efforts, or sharing equipment and facilities. Building a collaborative network helps lower individual costs while strengthening the community.

- Negotiate with vendors: Work with suppliers to reduce expenses on rent, loans, utilities, and insurance. Request extended payment terms, bulk discounts, or renegotiate contracts for more favorable pricing. These conversations can lead to significant savings over time.

Prioritize a positive outlook

In addition to understanding your business financials, cultivating a positive mindset can empower you to make thoughtful decisions, lower stress, and remain fully engaged in all aspects of your life. Here are some strategies to help foster and sustain a positive perspective:

- Reflect on the progress your childcare program has made

- Recognize the value and impact your work brings to your community

- Concentrate on areas within your control

- Build a support network of trusted colleagues, peers, friends, and family to encourage you along the way

Publish an annual report to share your program's financial status

Publishing an annual report is crucial for your childcare program's long-term financial health. This report highlights achievements, community contributions, and financial status, building trust and strengthening relationships with staff, families, board members, and partners. Present your story with transparency to align with sustainable financial practices.

- Showcase achievements and community contributions: Detail program milestones (e.g., increased enrollment, successful events) and community impact (e.g., collaborative projects) using specific examples and metrics.

- Present financial health: Provide a clear financial overview including income, expenditures, and budget, using visuals like charts. Explain significant financial changes and how funding supports initiatives.

10 tips for running a financially successful daycare business

Follow these expert tips on how to run a daycare to ensure your business is financially successful for years to come.1. Invest in training to reduce staff turnover

Strong relationships between children and their caregivers are essential for healthy development, and staff retention plays a key role in maintaining these bonds. Providing high-quality training and professional development equips your team to deliver excellent care and feel supported, which reduces turnover and elevates your program's quality.2. Encourage learning through play

Children learn best through play. Research shows that guided play, where teachers incorporate learning into fun activities, helps children grasp concepts more effectively. Creating a playful and engaging environment not only supports learning but also makes your program more memorable. Happy children share their excitement with families, leading to word-of-mouth referrals and increased enrollment.3. Keep your facility clean and well-organized

A clean, organized childcare facility is crucial for the safety of your staff and the children in your care. Follow all health and safety regulations, such as keeping first aid kits accessible and storing chemicals in locked, labeled containers. This will protect children from injury and your program from costly liabilities.4. Develop partnerships in your community

Partner with other childcare directors and daycare owners in your community to grow your connections and increase your enrollments. Offering to refer families to other childcare programs may lead to them returning the favor and referring families to your program when they don’t have the capacity for new clients.

5. Maintain open communication with families

Open communication builds trust with families, which can lead to increased enrollment. By discussing children's progress and addressing any questions or concerns, you strengthen your relationship with parents and guardians. Survey families regularly to collect feedback and improve the quality of your program.

6. Update your curriculum

Creating a research-based curriculum that meets the latest education standards will ensure that you’re teaching children lessons that are backed by current child development and early childhood education research.

With brightwheel's Experience Curriculum, you can support child development with a complete curriculum system that is research and evidence-based and aligned to all state early learning standards and NAEYC.

7. Utilize social media

Social media can raise awareness of your program, attract new families, and provide updates to current families. Share educational posts about your teaching philosophy or activities families can do at home. A business account is a great way to start conversations with your community and share information about your program.

8. Ask families to provide feedback

You can ask families to share reviews and feedback on your childcare program on social media and your website. Customer reviews can provide credibility for your services and lead to more families enrolling their children in your program.

9. Acknowledge and celebrate staff members’ achievements

Acknowledging and celebrating your staff members’ achievements, such as new promotions and certifications, will help your staff feel appreciated as valued members of your center’s team.

Celebrating your staff members creates a positive work culture that encourages productivity and growth. A positive work culture reduces staff turnover, so children continuously receive the best care and education from highly trained educators.

10. Optimize your employees’ schedules

You can reduce your program's expenses by simply reviewing your employees’ schedules to make sure their time is being spent efficiently. Keeping track of your employees’ hours and optimizing their schedules can help you eliminate unnecessary overtime costs and ensure that your program is fully staffed during peak times.

Frequently asked questions

How can I make my childcare program more profitable?

Increasing profitability begins with streamlining your operations and enhancing efficiency. Start by implementing automated systems for billing, enrollment, and attendance tracking to save administrative time and reduce errors. Brightwheel, for example, offers tools to simplify these processes while improving parent communication, leading to higher satisfaction and retention rates.

Additionally, consider optimizing your staff schedules to align with enrollment patterns and maximize productivity. Look for opportunities to diversify your program offerings, such as introducing after-school care or enrichment classes, which can bring in additional revenue. Finally, review your tuition rates regularly to ensure they reflect the quality of care you provide, while remaining competitive within your area.How do you expand a daycare business?

Expanding a daycare business requires careful planning and a strategic approach. Start by assessing the demand in your community to identify whether there’s a need for additional capacity or new services, such as infant care or after-school programs.

Next, evaluate your current location’s performance and operations to ensure you have a strong foundation before scaling. Consider opening a new location in an area with high demand, and streamline operations with tools like automated billing and parent communication platforms to save time and increase efficiency.

Are daycares affected by recessions?

The childcare industry feels the impact of economic recessions, as financial uncertainty can lead to lower enrollment and revenue for daycare providers. During downturns, fluctuations in parental income may reduce demand for care, placing financial pressure on programs.

Still, childcare businesses can proactively navigate these challenges. By closely monitoring finances, diversifying income streams, and maintaining high-quality services, providers can bolster their resilience during tough economic times. Adapting strategies and staying flexible is key to sustaining your program, even when the economy shifts.